It's no secret that the cost of attending college is getting more expensive. The nation's top 50 private universities raised tuition by an average of 3.6% for the 2017-18 school year according to a USA Today analysis. Meanwhile, inflation hovers around 2.2% for the last 12 months. That's not a great trend for families already stretching their budget to pay for a college education.

So in a climate of rising tuition costs, is college really worth it? Some, like PayPal co-founder and prominent tech investor Peter Thiel, would have you believe that it's not. His Thiel Fellowship offers students $100,000 over two years to forgo college and start a company instead. Former Harvard president Larry Summers, meanwhile, has called the Thiel Fellowship the “single most misdirected bit of philanthropy in this decade” and maintains the importance of the college experience.

We've used data from PayScale's 2017-2018 College Salary Report and its 2017 College ROI Report to assess the economic value of a college education today. PayScale's reports reflect the responses of 2.3 million college graduates from over 1,500 schools who have taken their online salary survey.

Attending a Top University Pays Off

First, a look at the economic prospects of graduates from America's best universities. Based on PayScale's data, it seems that if you can get into a top school, it's still well worth the investment.

All universities in the top 20 of U.S. News's 2018 list show a very positive return on investment (ROI) over a 20-year horizon. Schools like MIT and CalTech -- known to be among the best engineering schools in the country -- stand out with particularly high early career pay and strong ROI. Based on PayScale's data, MIT grads can expect to have made almost $1 million more after 20 years than if they immediately started working full-time after high school. (See the last section for more on how ROI is calculated.)

There is some variability in ROI across top schools. A graduate of the University of Chicago will only see a return of about $365,000 over 20 years, less than 40% of what PayScale projects for an MIT grad. UChicago, Northwestern, Vanderbilt, and WashU -- all top 20 schools according to U.S. News -- don't crack the top 100 in terms of ROI.

Still, attending any top school seems more than worthwhile. Relative to all U.S. colleges, a top school is a safe financial bet.

Across all colleges in PayScale's 2017 survey, the median ROI is $176,000 over 20 years. Almost 93 percent of schools are projected to provide a positive return.

The universities that fell within the top 100 in this year's U.S. News rankings, however, did even better. The median return for those schools is over $420,000. Every single university in this group has a positive ROI according to PayScale.

Want Great Value? Go In-state.

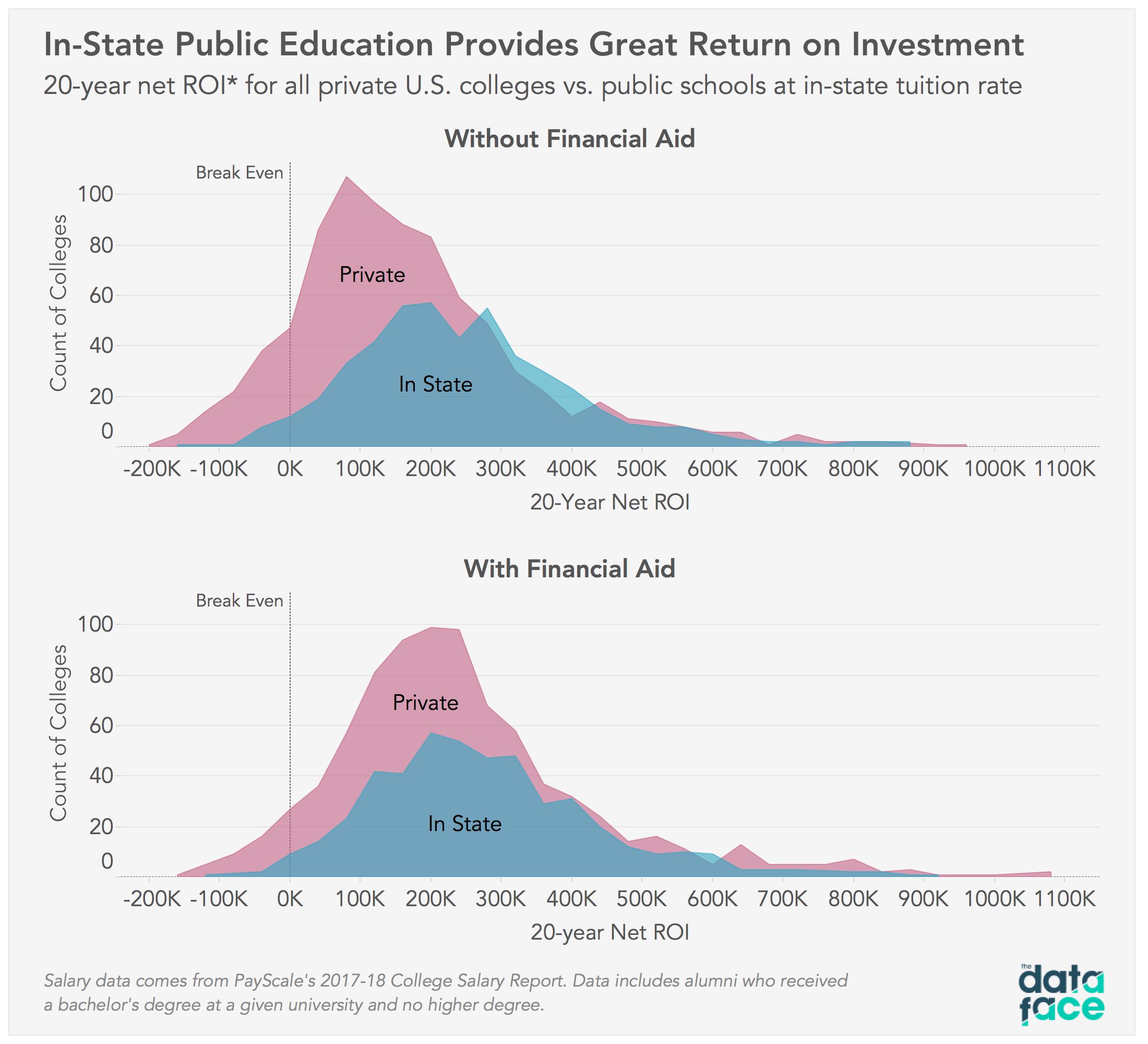

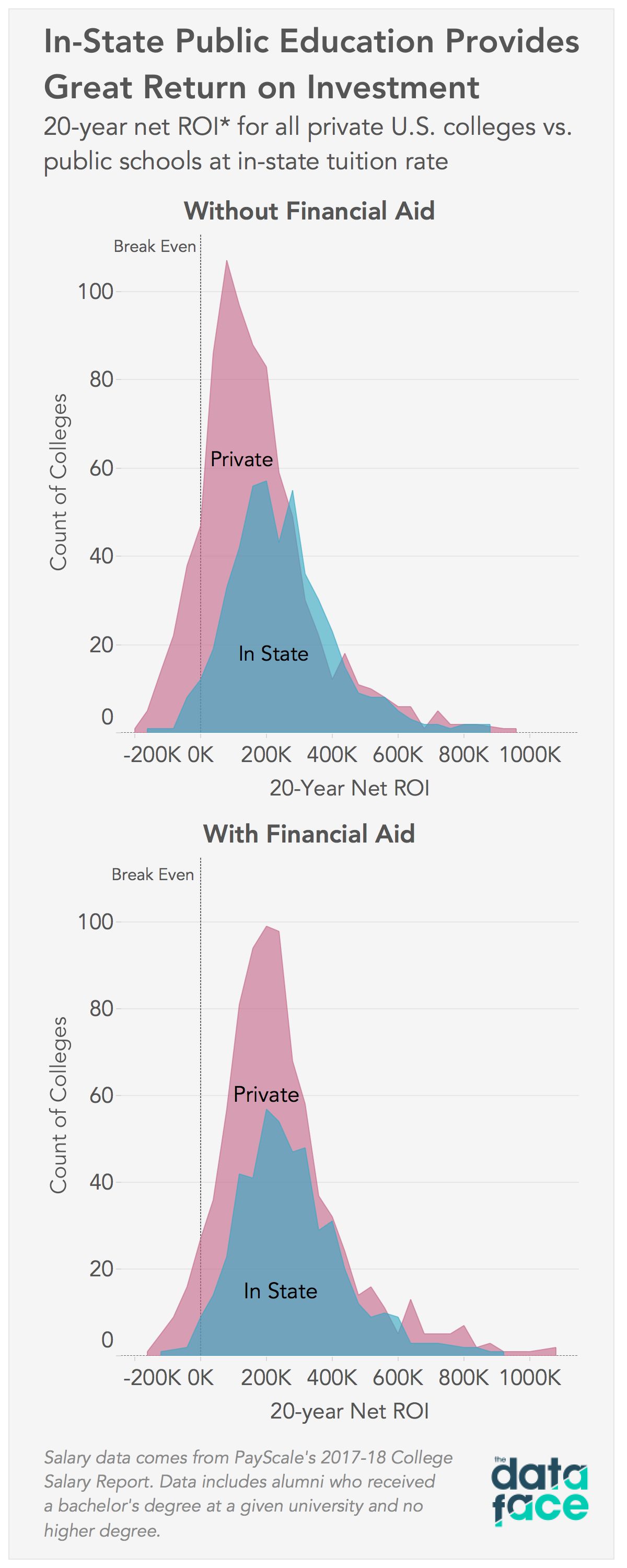

The majority of schools towards the top of U.S. News's list -- and every university in the top 20 -- are private institutions. So what about their public counterparts? Can students still derive long-term value from an education at a public school in their state? The answer seems to be a resounding yes.

Without any financial aid, almost 10% of private universities are projected to have a negative ROI over 20 years. On the other hand, only 10 public universities (out of 473 surveyed) have a negative expected return at the in-state tuition rate. That's just over 2%.

Even accounting for financial aid, the conclusion doesn't change much. Less than 4% of private schools have a negative ROI if we deduct the average financial aid package from each school's total costs. If we do the same for public universities at the in-state tuition rate, only three (<1%) still have a negative ROI. In the aggregate, the vast majority of public and private institutions seem to be worth the money.

This doesn't end the conversation on the value of a college education. We haven't considered how the type of degree that a student receives will impact the ROI of attending college. Certainly a drama major and mechanical engineering major will expect to see very different returns over the course of their life, irrespective of the school they attended. Still, assuming you choose the right major at a decent school, it seems that college still makes plenty of financial sense.

Methodology:

Our analysis is based on data from PayScale's 2017-2018 College Salary Report and its 2017 College ROI Report. Here's a synopsis of how PayScale calculates return on investment:

In calculating the return on investment, we must first determine the investment in college and the return from attending college. The investment is the cost of college as determined by the actual cost of attending college. The return (gain) is the additional expected future income stream received for being a college graduate.

Investment in College: This investment in college is the cost of attending college, as calculated by the cost for a Graduate in 2015. We've used on-campus costs as the basis of our analysis, which is the sum of Tuition and Fees, Room and Board, as well as Books and Supplies for each academic year. Data supplied by IPEDS.

Return from Attending College: We calculate the gain in median pay over a high school graduate (Earnings Differential) as the difference between the 20-Year Pay for a 2016 Bachelor's Graduate and the 24-Year Pay for a 2016 High School Graduate.

To read more about how PayScale models median pay for bachelor's and high school graduates, visit this page.

Nerd Notes:

Graphics were created in Tableau.

You can see the complete data from PayScale's reports by going here.